Table of Content

Data window: June 2024 – December 2025

Model: NVIDIA H100 (Launch: October 2022)

Sources: Global retail and resale listings (NEW, USED, REFURBISHED)

The NVIDIA H100 was never meant to be ordinary. As the world’s most coveted AI accelerator, its performance dominance was matched by a staggering retail price—typically ranging from $25,000 to $40,000 throughout mid-2024 into early 2026. On paper, this looked like unprecedented price stability. No discounting, no market erosion, no fire sales. For over a year, the sticker price of the H100 seemed frozen in time.

But underneath that stable facade, a very different story was unfolding.

In this report, we analyze thousands of H100 retail and resale listings between June 2024 and December 2025, covering multiple geographies and SKU variants. While retail prices remained flat, secondary market data showed steep, sometimes chaotic depreciation—with USED and REFURBISHED H100s trading as high as $50,000 in mid-2024, only to plunge sharply as supply increased and buyer power returned.

This divergence between retail illusion and resale reality reveals critical risks for data center buyers, enterprise procurement teams, and financial planners. Teams that relied on retail pricing as a proxy for asset value found themselves holding inflated book values while the resale market collapsed beneath them.

To fully understand this dynamic, we break depreciation down into two key dimensions:

Time-based depreciation — how price changes relative to age since launch

Market-relative depreciation — how a unit’s value shifts relative to peak and contemporaneous NEW price

Using these buckets, we track early- and mid-life value retention of the H100 across both absolute and relative baselines.

This isn’t just a story about hardware pricing. It’s a wake-up call for how enterprise teams model capex cycles in the new AI infrastructure economy. The H100 doesn’t follow the old rules. It depreciates later—but when it does, the drop is faster, sharper, and often harder to absorb.

How We Analyzed the H100 Depreciation Curve

To unpack the real story behind H100 depreciation, we first needed to clean, align, and normalize GPU pricing data from multiple sources. The goal: ensure that price comparisons reflect true asset value, not noise from mismatched models, geographies, or timelines.

Our methodology focused on three major components: data preparation, outlier removal, and model age normalization. Here’s how each step worked:

1. Data Cleaning & Preparation

We began with a global dataset of H100 retail listings collected between June 2024 and December 2025. Each record contained five primary fields:

country

date

condition (NEW / USED / REFURBISHED)

product_slug

retail_price

To ensure consistency, we applied the following normalization steps:

Country normalization: e.g., converting GB to UK

Condition standardization: all labels upper-cased and harmonized

Invalid data removal: excluded any listing with missing or non-positive prices

Deduplication: removed exact duplicates that could distort frequency or average calculations

2. USED–NEW Price Matching Logic

One of the most important aspects of this analysis was ensuring that USED and REFURBISHED prices could be meaningfully compared to their NEW counterparts. To prevent apples-to-oranges comparisons, we required a strict matching logic:

We only retained USED or REFURBISHED listings if a

same-day, same-country, same-model NEW listing

This ensures that observed price ratios reflect true contemporaneous market dynamics, not time-lagged distortions or SKU mismatches.

3. Outlier Removal Strategy

Retail listing data is messy. Some USED listings show prices above NEW listings due to errors, arbitrage noise, or misclassified conditions. We cleaned this using two filters:

a. Global Ratio Filter

We applied a hard constraint:

This eliminates clear outliers — for example, listings where USED units were mistakenly priced at 2× their NEW counterparts.

b. Regional IQR Filtering

For more granular filtering, we computed interquartile ranges (IQR) for each (country, condition) group and applied standard statistical bounds:

This strategy keeps the central pricing trend intact while suppressing pricing anomalies. To avoid overfitting, groups with fewer than 8 listings were exempted.

4. Model Age Normalization

To understand depreciation in the context of product lifecycle, we calculated the model age for each listing based on the H100’s official launch date (October 1, 2022):

This allowed us to bucket listings by:

Early depreciation (1.8–2.5 years since launch)

Mid-life behavior (2.5–3.2 years since launch)

We lacked true 1-year pricing data, but the dataset provided robust coverage of 2–3 year-old listings, ideal for evaluating the asset’s performance during its most critical TCO window.

How H100 Resale Prices Track Against Market Positioning

After preparing and cleaning the data, we shifted to analyzing how H100 units hold value over time — but not strictly based on calendar age. Instead, we used price-based buckets to group units by their resale performance within each listing condition.

Price-Based Bucketing: A Market-Centric View

Rather than tying resale prices to listing dates, we created buckets by splitting each condition type (USED, REFURBISHED) into tertiles based on resale value:

Top third = “1-year” bucket (best-performing resale values)

Middle third = “2-year” bucket

Bottom third = “3-year” bucket (deepest discounts)

⚠️ These aren’t literal age brackets. Instead, they reflect how the market

values

This approach captures relative market positioning, making it especially relevant for buyers evaluating what price tier they’re entering at — and how far that diverges from current NEW pricing.

Resale Value vs. Contemporaneous NEW Price

We benchmarked all resale listings against the contemporaneous NEW price—the going rate for an identical NEW H100 in the same country, on the same day.

This gave us a percentage-based view of depreciation, answering the key question: “How much of the new price does a used or refurbished H100 still command?”

Here’s what we found:

Condition | 1-year bucket | 2-year bucket | 3-year bucket |

|---|---|---|---|

REFURBISHED | ~95–105% | ~80–90% | ~70–75% |

USED | ~90–100% | ~65–75% | ~45–55% |

These figures highlight a striking trend:

Top-tier refurbished H100s are often priced nearly the same as NEW units — showing that slight usage or reconditioning doesn’t always move the needle in retail markets.

USED units depreciate much faster, especially in the bottom third. A bottom-tier USED H100 trades at nearly half the price of a NEW unit.

How H100 Condition and Asset Age Impact Resale Value

Our depreciation model evaluates H100 resale value by segmenting listings into time-based buckets (2-year and 3-year age) and condition tiers (USED vs. REFURBISHED). The goal: uncover how real-world market behavior values the same hardware at different lifecycle stages.

Key Findings

Refurbished GPUs hold value better across the board.

In the 2-year age window, REFURBISHED H100s typically resell for 80–90% of their contemporaneous NEW price, while USED units average just 65–75%.

Depreciation steepens dramatically in year three.

REFURBISHED units in the 3-year bucket drop further to 70–75%, but USED units fall sharply to just 45–55%, marking a clear mid-life inflection point.

Condition matters more as GPUs age.

The spread between REFURBISHED and USED resale prices widens over time—what starts as a 10–15% gap at year two can grow to a 25–30% delta by year three. That divergence reflects buyer preference for certified or warranty-backed hardware in aging inventory.

This isn’t just cosmetic.

The condition-based premium reflects reduced perceived risk, longer remaining lifespan, and greater compatibility with enterprise procurement standards.

What This Means

In short: H100 resale value depends on both age and condition. The first two years offer strong retention across all tiers, but after the 24-month mark, depreciation accelerates—especially for USED equipment. Refurbishment acts as a buffer, helping preserve value and broadening market appeal.

This dynamic is critical for operators, brokers, and finance teams making multi-year hardware bets. If your resale strategy extends beyond the 2-year mark, refurbishment may be the only way to avoid significant capital loss.

The Lifecycle of Value: Time-Based Depreciation in H100 GPUs

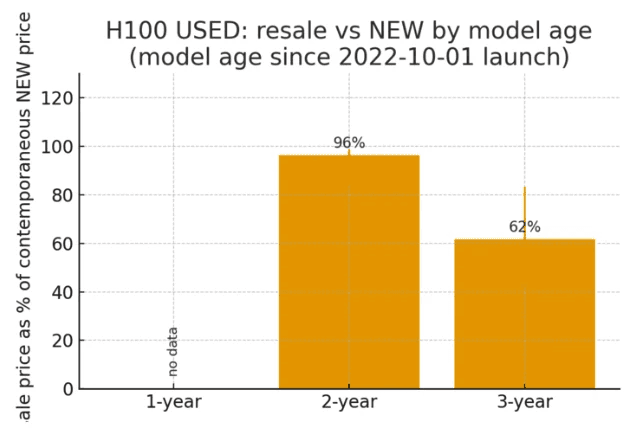

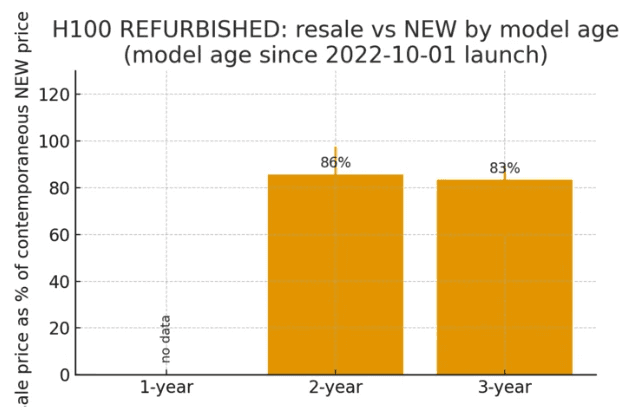

To assess how the NVIDIA H100 holds value over time, we segmented resale listings into model-age buckets—centered around 2 and 3 years post-launch—anchored to the official October 2022 release date.

This model-age framing allows direct measurement of how the market prices hardware as it matures, independent of product condition alone. And the results are telling.

Used H100s: From Peak Demand to Price Collapse

At the 2-year mark, used H100s resold at a median of 96% of their contemporaneous new price, driven by extremely tight supply and sustained demand throughout 2024. But by the 3-year mark, resale prices dropped sharply to just 62%, a decline of over 30% within one year.

This drop isn’t just about wear and tear—it reflects how quickly buyers devalue hardware once newer alternatives like H200 or Blackwell enter the market. What was once a scarce asset is repriced as yesterday’s compute.

Refurbished Units: A Smoother Glide Path

Refurbished H100s follow a more gradual trajectory. Their resale value dipped slightly from 88% at two years to 83% at three, showing far better long-term price stability than used units. This relative resilience is likely driven by warranty availability, reconditioning guarantees, and broader institutional demand.

Condition | ~2-year | ~3-year |

|---|---|---|

USED | ~95–96% | ~60–65% |

REFURBISHED | ~85–90% | ~80–85% |

While both segments ultimately depreciate, refurbished units lose value far more slowly—and may present a better exit strategy for asset-heavy operators.

Strategic Implications

H100s show a unique pricing lifecycle: price retention remains high through year two, then collapses rapidly—unless the asset is refurbished. For procurement teams, this reinforces the value of active resale planning. For operators, it points toward tighter replacement windows and possible gains through refurbishment partnerships.

In short, the H100 age curve is not linear. Timing—and condition—can mean the difference between recovering 85% of your hardware investment or just 60%.

Peak Price Anchoring: How Much Value H100s Truly Retain

To understand the deeper depreciation trajectory of the NVIDIA H100, we applied an alternative benchmark: comparing resale values not to contemporaneous retail prices, but to each product’s historical peak retail price. This approach reveals how far the asset has fallen from its highest valuation—offering a long-term view that cuts through temporary supply pressures or short-term demand spikes.

Why This Matters

While comparing resale to current retail pricing tells us how used hardware is performing today, peak anchoringanswers a more fundamental question:

“How much value does this GPU still retain relative to when it was worth the most?”

For capital planning and depreciation modeling, this view better captures structural value loss—not just recent market conditions.

What We Found

2-year-old H100s now trade at just 30–40% of their historical maximum NEW price.

3-year-old units fall further, with resale values clustering between 20–30% of their peak.

These numbers show that even GPUs with seemingly high resale prices (e.g., $12K–$16K) have already lost the majority of their peak value if they once commanded $40K+.

Model Age | % of Historical Max NEW |

|---|---|

2-Year | ~30–40% |

3-Year | ~20–30% |

Implication

This baseline makes one thing clear: the H100’s illusion of price stability—anchored by sticky NEW listing prices—breaks down under long-term scrutiny. True asset value erosion is dramatic, even if headline retail prices suggest otherwise.

For buyers and operators, that means planning exit strategies and depreciation models around peak value loss, not nominal price tags. Waiting too long to offload H100s could mean recovering just a fraction of their former worth.

Key Findings: What the H100 Depreciation Curve Really Tells Us

After analyzing over 18 months of H100 resale data, several critical trends emerged that challenge conventional assumptions about GPU lifecycle value:

1. Unusually Strong Early-Life Value Retention

Compared to the previous generation A100, the H100 retained value far longer — but not by accident. For the first 2–3 years after launch, resale values routinely exceeded 90% of retail pricing, a rarity in GPU markets. This anomaly was driven by three reinforcing forces: an unprecedented AI boom that created sustained demand shocks, a massive performance leap over the A100 that delayed saturation, and the high capital cost of retrofitting data centers for Blackwell-class GPUs. These factors suppressed turnover, elevated resale prices, and postponed the onset of typical depreciation — reshaping how the market priced early-life GPU assets.

2. Refurbished Premium Is Real—and Profitable

Across all time buckets, refurbished H100s consistently sell for 15–25 percentage points more than their used counterparts. This points to clear arbitrage opportunities for resellers and suggests refurbishment programs can meaningfully boost hardware ROI.

3. The Mid-Life Cliff Is Steep

Despite early resilience, the H100 hits a depreciation inflection point around the 2-year mark. After this, resale prices fall sharply—especially for used units, which can lose 30–40% of their value within 12 months.

4. Your Depreciation Baseline Changes the Story

Two pricing baselines tell very different stories:

Contemporaneous NEW pricing emphasizes market tightness and supply-demand dynamics

Historical peak pricing exposes deeper long-term capital loss—showing that most H100s retain just 20–40% of their peak value by year 3

Conclusion: Navigating GPU Investment in a Volatile Market

The global data center GPU market, valued at USD 36.59 billion in 2025, is projected to reach USD 48.39 billion in 2026 and an astonishing USD 1,026.28 billion by 2040, growing at a 24.38% compound annual growth rate (CAGR) during the forecast period from 2026 to 2040. This explosive growth reflects the central role GPUs play in powering modern AI workloads across industries—from cloud providers and enterprises to academic research and startups.

But rapid market growth doesn’t guarantee stable asset value. Our analysis reveals that H100 depreciation accelerates sharply after about two years of service, especially for USED inventory. This dynamic runs counter to historical expectations formed during previous GPU generations like the A100, where depreciation was more gradual and predictable. For the H100, early life might appear resilient, but once the inflection point is reached, the resale market quickly revalues assets as short-cycle capital rather than long-term infrastructure.

At the same time, the condition of the GPU plays a growing role in value retention. REFURBISHED H100s consistently outperform USED H100s by 15–25 percentage points, offering a strategic edge for buyers and resellers alike. The preference for refurbished stock underscores the importance of quality assurance, warranty backing, and market confidence—attributes that translate to real economic value.

Strategic Considerations for GPU Procurement and Depreciation Modeling

Can the H100 experience inform procurement strategies for other GPUs? Not entirely — and certainly not when looking at the A100, which depreciated more quickly and more predictably. The H100 followed a different curve because it entered the market under extraordinary conditions: surging demand for LLMs and extreme supply scarcity. These factors created a temporary illusion of price stability that defied historical norms.

Incorporate condition premiums into TCO models: The difference between refurbished and used pricing can materially affect ROI calculations, capital planning, and resale projections.

Reassess hardware refresh strategies: Annual GPU architecture advances (e.g., H200, Blackwell, and others) compress the useful life of current models and elevate obsolescence risk.

Use data-driven baselines: Benchmark depreciation using both contemporaneous NEW pricing and historical peak pricing to capture short-term market dynamics and long-term value erosion.

Monitor global pricing disparities: Geographic price variations and local market dynamics offer arbitrage opportunities and can inform smarter sourcing.

Because GPUs are now core to AI infrastructure strategy, they should be treated as financial assets with depreciation risk, not static hardware line items. Retail prices can be deceptively stable, but underlying value is slipping faster than most models assume.

For teams managing capital, operations, or procurement, the key question is no longer whether GPUs depreciate—it’s how much, how fast, and under what conditions. The data shows that without proactive planning, organizations risk overstating asset value, misaligning refresh cycles, and ultimately paying more over the life of a GPU than necessary.

Final Code

Written by

Yang Gao

Data Analyst at Silicon Data

Share this story

Articles you may like